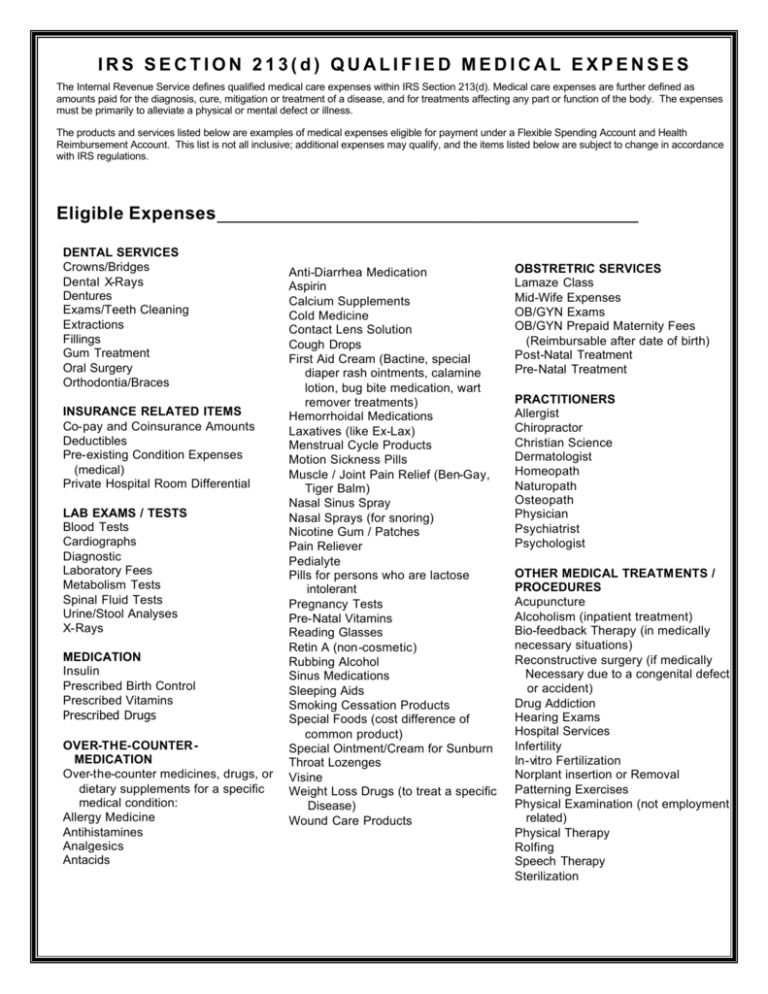

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

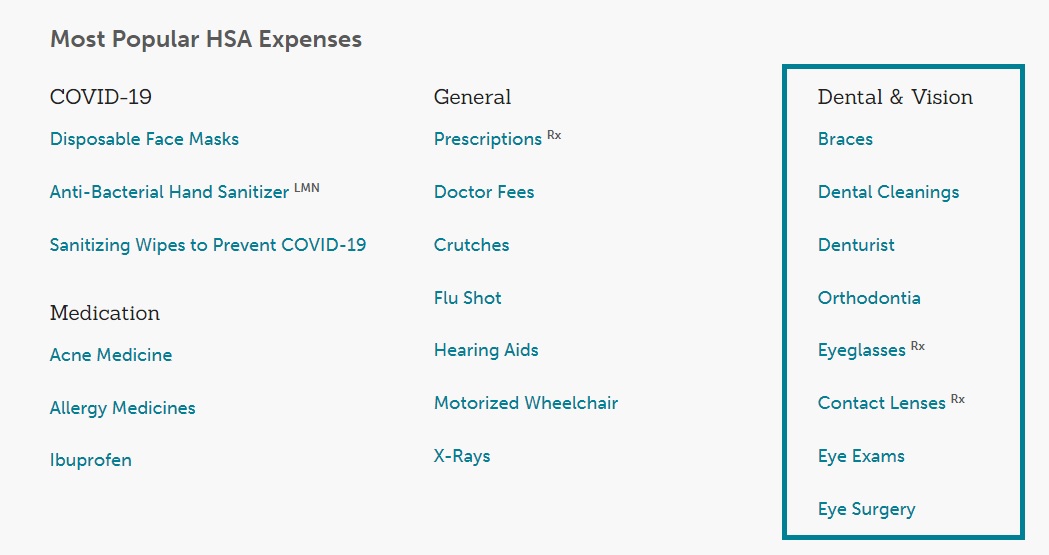

Understanding HRA eligible expenses, BRI

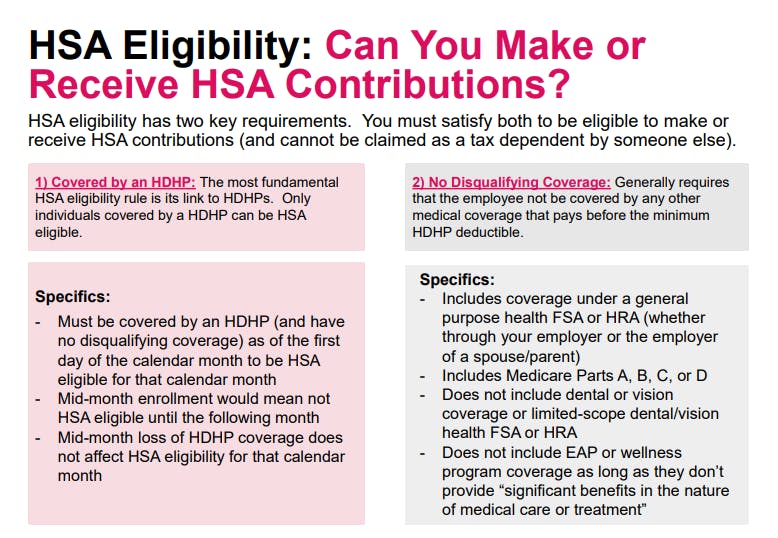

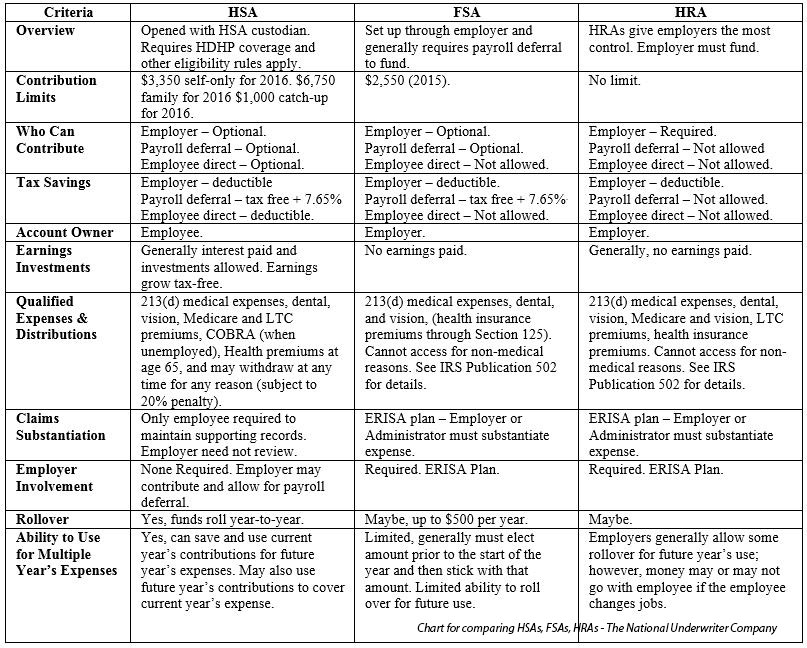

IRS Answers FAQs On Medical Costs Paid Under HSA, FSA, And HRA Plans

HSA Establishment Date

Flexible Spending Account (FSA) Basics – Sheakley

Is it allowed to deduct cosmetic medical procedures as an itemized

Publication 502 (2022), Medical and Dental Expenses

9 Top FAQs about HSAs, FSAs, and HRAs

IRS SECTION 213(d) QUALIFIED MEDICAL EXPENSES

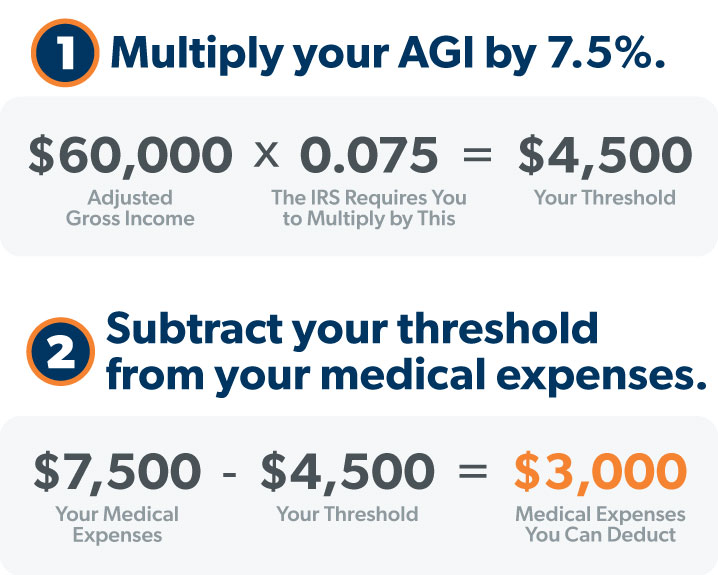

Can I Deduct Medical Expenses? - Ramsey

Personal Spending Accounts

Leveraging Medical Savings Accounts for Integrative Health

Tax Implications (and Rewards) of Grandparents Taking Care of

Effective January 1, 2011 due to Health Care Reform, over-the

2024 COLAs - Health FSA, Qualified Transportation and More

FAQ - Health FSA and Dependent Care Assistance Plan DCAP FSA